Have central banks changed direction?

It’s not just the weather that has left an autumnal chill in the air; central bankers have returned from their summer hols with a slightly harder edge to their comments. Underneath the contradictory guidance and the daily flip-flopping of opinion, we get the feeling that the free drinks are being gently removed from the party.

September’s round of central bank meetings produced little in the way of action but showed a growing confidence in the economic outlook and produced some direct comments alluding to monetary tightening in the not too distant future.

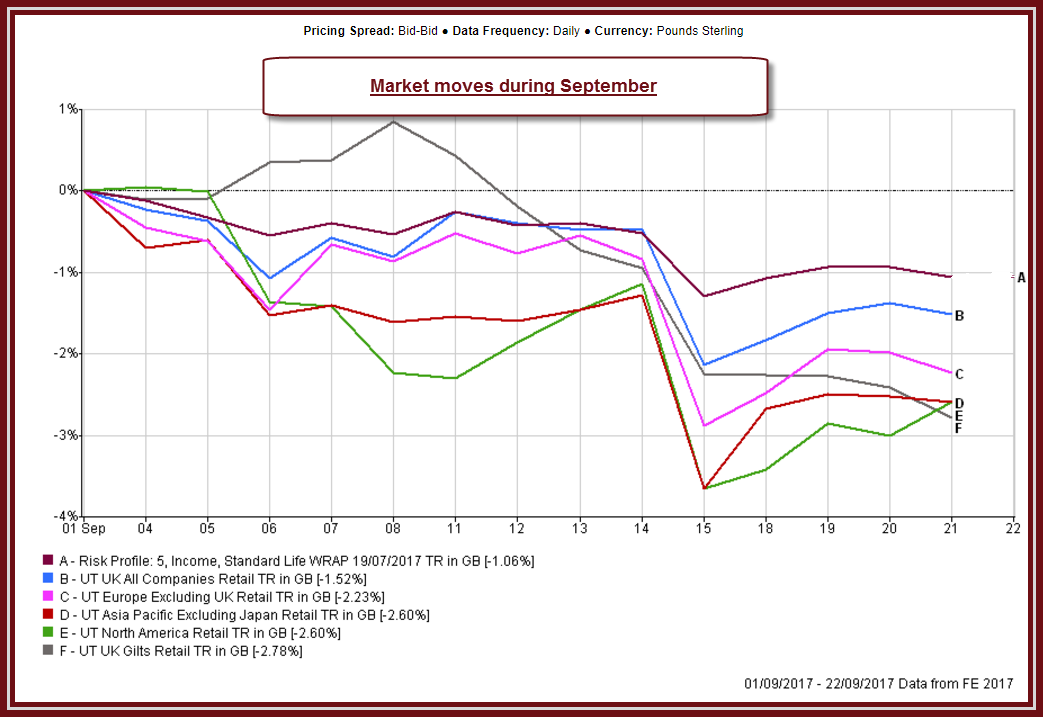

UK-based investors fared worse than most; the prospect of a (small) rise in interest rates led to falls in shares and bonds whilst the stronger currency translated rising overseas markets into sterling losses.

Note that our income fund was less volatile and didn’t suffer as badly as individual sectors; the fund is still up around 4.7% this year.

Below is a summary of the main September meetings:

US Federal Reserve

There were no surprises from this month’s meeting that confirmed a vote to leave interest rates unchanged for now but to press ahead with the very gradual removal of quantitative easing. To recap, the quantitative Easing (QE) programme involved the central bank injecting money into the system by buying up trillions of dollars of bonds and holding them on its balance sheet.

The Bank’s plan to reverse its bond holdings won’t involve selling bonds any time soon, but will see a scaling down of the reinvestment of coupon and redemption proceeds. From October, this reinvestment will be cut by up to $10bn a month; the limit on reinvestment is scheduled to increase by $10bn every three months to a maximum of $50bn for the foreseeable future.

Commenting that the labour market has continued to strengthen and economic activity has been rising moderately this year, Chair Yellen also confessed that this year’s inflation undershoot was a “mystery.”

Board members continued to signal one more rate rise this year, likely in December, and three more next year, although current bond market pricing shows scepticism that rates will rise that far.

European Central Bank

The ECB are on record as saying that rates will remain unchanged for an extended period and that a change to the asset-purchase programme would happen before any rise in rates. Investors were disappointed at the lack of clarity on the level of asset purchases for 2018; the existing programme of Euro 60 billion a month runs out at the year-end at which point the monthly amount was expected to be reduced.

The minutes portrayed a sanguine view of economic growth but concern over the recent strength of the euro and its possible implications for price stability. Concern over the stronger currency is, according to leaked reports, dividing members on whether to postpone any announcement on further asset purchases until December with some members wanting to extend, or even increase, monetary stimulus in the new year.

The ECB have a slightly different problem in that theirs is a single strict mandate. Whilst the US and UK have dual mandates promoting employment and growth along with price stability, the ECB is tasked solely with ensuring price stability with a rate of inflation below, but close to, 2% over the medium term. With inflation below target this explains their reluctance to rein in existing accommodative policy.

Bank of England

The recent meeting of the Monetary Policy Committee resulted in no policy changes, as expected, with an unchanged 7-2 vote in favour of unchanged rates.

However, the surprise came from the accompanying minutes which, after all the usual ‘on the one hand/ on the other hand’ fluff, offered two comments that had an immediate effect on markets.

The first, wasn’t a new comment but reiterated that if the economy followed the path of members’ central projections (in August’s Inflation Report) then monetary policy could need to be tightened by more than current market expectations (i.e. yields are too low).

The second comment stated “…some withdrawal of monetary stimulus is likely to be appropriate over the coming months…”. The bit that really got markets excited was that this view was unanimous.

There’s no October meeting so current expectations centre on a rate rise at the 2nd November meeting, which coincides with the release of the quarterly inflation report.

What can we expect going forward?

We can expect more wobbles! Few economies have unequivocally strong data, and the UK has the additional worries of both Brexit and the question of whom, if anyone, is running the country. These uncertainties stray well beyond normal historical patterns and, we believe, will lead to an extremely cautious attitude to monetary tightening in the UK. Bond markets are attaching a 75% probability to a quarter point rate rise before the year-end on both sides of the Atlantic, but aren’t expecting anything other than a gradual tilt towards further tightening next year.

It would be reasonable to expect an increase in volatility as investors react to economic data that either supports, or contradicts, the need for further tightening. We still believe that markets are due a correction, if only to clear the air. But with interest rates expected to remain low for months, if not years, then investors will continue to seek income from assets such as bonds, equities and property.

How are we positioned?

Each risk-level portfolio will differ but our central themes are:

- Where we hold fixed income, we use a spread of funds with reduced exposure to rising rates; these funds include corporate bonds and bonds that rise in line with inflation or interest rates.

- Our UK equity exposure shows a preference for the defensive qualities of income funds that are generally less volatile.

- Our overseas equity funds spread risk between the US, Asia, Japan, emerging markets and Europe, with a bias towards funds that concentrate on risk-reduction.

- We use gold, targeted return and property funds to further diversify risk.