Is the Trump rally fading and, if so, where does that leave us?

INVESTMENT SPECIALIST DAVID WARREN AT DISCRETIONARY INVESTMENT MANAGERS CHARLWOOD IFA SHARES HIS VIEWS ON MARKET EVENTS FOR MARCH 2017

Napoleon once said, “If you wish to be a success in the world, promise everything, deliver nothing.”

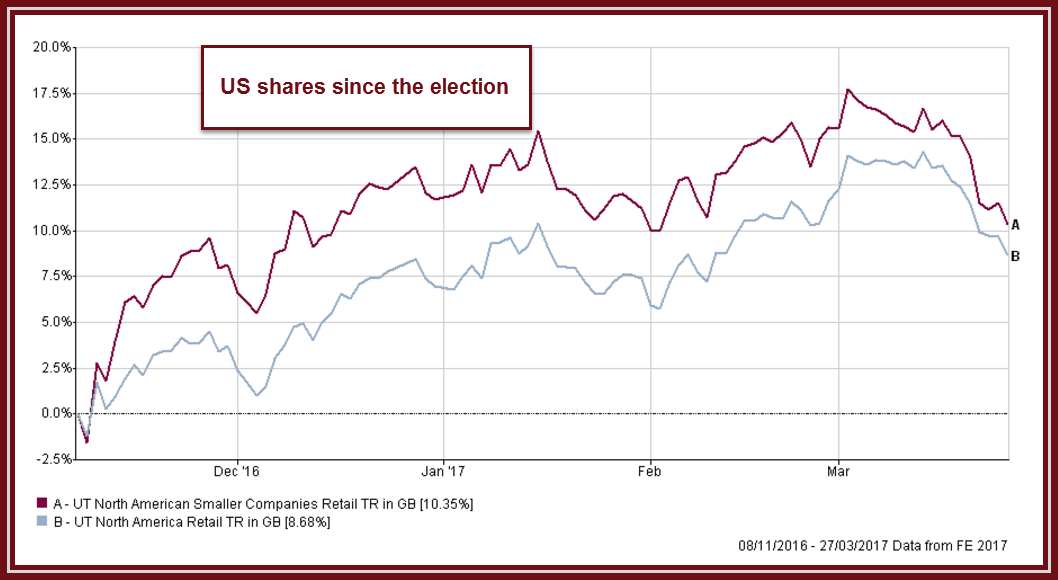

Since November’s shock election result stock-markets have soared on a wave of perma-tan and hairspray, buoyed by the prospect of President Trump’s new tax reforms, fiscal stimulus plans and a pledge to cut the mountainous spool of red tape.

US shares led the way, gaining 13% in sterling terms between November 8th and March 15th; Europe and the UK rallied by around 9%. The prospect of a prolonged period of economic expansion pushing interest rates higher saw the US dollar break above previous resistance, hitting a multi-year high in late December; yields on US 10-year bonds peaked at 2.62%.

The question is whether, four months into the presidency, March 24th was the day when the little boy pointed out that The President wasn’t wearing any clothes?

After a couple of early wins Trump had tried to push through his immigration ban but was faced down with international and national challenges to its implementation. Undeterred, the President focussed on his American Health Care Act to replace Obamacare, but this was thrown out by his own party ahead of a potentially humiliating vote. The much-heralded announcement on tax reform has already been postponed once and now there’s a growing suspicion that the President might struggle to gain approval for anywhere near the fiscal expansion originally signalled.

And now, pushing to the front of the queue, is the prospect of a government shutdown if the funding for government agencies isn’t approved before its end-April deadline. Previously this had been considered a formality, what with a Republican majority in Congress, but after the Health Act was sabotaged from within by an ‘invitation only’ Republican group known as the Freedom Caucus; the fear is that they may now block, or extract concessions, for approving the future funding bill.

In the week of, and following, the failed Health Care Act US shares fell by around 4% in sterling terms, 10-year bond yields fell by nearly 25 basis points and the dollar trade-weighted index dropped 3%. Markets have since backed off the more extreme levels but there’s likely to be a nervous uncertainty over the next month.

In our view, it’s a bit too dramatic to claim that we’re all doomed if the Trump rally turns cold. Firstly, a market correction would be healthy in shaking out some of the complacent, hot money and attracting long-term investors at more reasonable levels; secondly, the global economy isn’t in too bad a place just yet.

Even a watered-down version of Trump’s agenda, together with his having more control over incoming Federal Reserve members, could prolong the economic growth cycle, just not to the extent initially envisaged.

Further, if you ignore the politics, there’re encouraging economic noises emanating from Europe. It’s too early to tell whether rising inflation is transitory or whether it will become ingrained (none of us know what effect years of excessive money supply will have on future inflation). However, signs of improving growth are becoming more widespread with forward-looking business and confidence surveys pointing towards stronger economies.

To date, the UK hasn’t suffered from the feared post-referendum Carney carnage, though it’s unrealistic to expect the economy to remain unscathed from the uncertainties surrounding two years of Brexit negotiations. Elsewhere in the world, there’re signs of recovering growth in Japan and many emerging markets, with global trade at a 7-year high.

For now, there appears to be little rush to raise interest rates outside of the US, so with no real return from cash on offer there’s likely to be a constant flow of savings looking for higher returns. In addition, the central banks in Europe, the UK and Japan are still providing support through their asset purchase programmes.

The game-changer would be If economic growth accelerates, at which point interest rates might need to be raised and pressure would increase on central banks in the US, UK, Europe and Japan to taper, stop or even reverse their asset-purchase programmes. The challenge then will be to remove investors’ comfort blanket with-out provoking an almighty tantrum.