Spotlight on: Investment risk

INVESTMENT SPECIALIST DAVID WARREN AT DISCRETIONARY INVESTMENT MANAGERS CHARLWOOD IFA SHARES HIS VIEWS ON MARKET EVENTS FOR FEBRUARY 2017

One of the major considerations for a client when contemplating an investment portfolio is their attitude to risk. The adviser and client will have a discussion resulting in the selection of a portfolio best suited to the agreed level of risk; the level of risk selected will determine the blend of fixed interest, property, equities and cash.

Traditionally, the blending was fairly straight-forward; the more cautious the risk, the higher the fixed interest content and consequently the lower the equity weighting. As the desire for more risk increased, the fixed interest weighting would give way to more equities-property would be used to diversify the risk of the other asset classes.

However, over the past few years low inflation and central bank asset-purchase programmes (Quantitative Easing) have distorted the norm, sending fixed interest bonds to levels where the risk out-weighed the reward, making them a less obvious selection for cautious portfolios.

With this in mind I’ve provided a quick guide to the different risks posed to asset classes, and I’ve thrown in an often over-looked risk at the end.

Fixed Interest

Historically considered the safest asset class there are now several categories of bonds that are exposed to (or hedge against) different risks:

- Government bonds have the lowest credit risk (the risk of not getting all your money back) but are exposed to interest rate and inflation risk (the fixed income and final payments become worth less in the future, even during periods of modest inflation).

- Government Index-linked bonds have a low credit risk and don’t lose out (as much) to inflation because the income and final repayment are adjusted in line with inflation. In the UK, pension fund demand for these bonds means that they’re highly-priced with some bonds currently offering a return less than inflation.

- Corporate bonds have a higher credit risk (because these are loans to companies) and still suffer from inflation. However, they do offer more income to compensate for the risks and many of these bonds are issued by high-quality companies like Unilever, Microsoft and Nationwide.

- High-Yield bonds used to be called ‘Junk bonds’ because of their lower credit quality, before the marketing people re-branded them. They’ve potentially been mis-sold to large amounts of investors looking for more yield, but a well-researched fund, such as those used by ourselves, can add value to the portfolio. High Yield bonds trade differently to other bonds and have a much higher credit risk but their shorter maturity and higher income mean that they suffer less in the event of rising inflation or interest rates.

- Floating Rate Notes are almost entirely corporate debt but with an income that is linked to short-term interest rates. There is some credit risk but very little inflation or interest rate risk.

Property

- Funds that invest directly in properties diversify across the main categories of office, retail and industrial. Their ability to raise rents reduces the risk from inflation, although if rising inflation feeds through to higher interest rates then financing will be costlier and consequently prices might fall. Property funds are exposed to credit risk-the risk of tenants not paying their rent, and the risk of empty properties in tougher times. On the whole some exposure to property damps down the extreme price movements of a portfolio but they are exposed to liquidity risk where delays in selling properties to meet fund redemptions may result in suspending dealings in the fund (you can’t get your money out as quickly as you might like!).

Equities

- Equities are exposed to credit risk to a greater degree than bonds. UK income funds are usually considered to be the least risky with the degree of risk rising in funds exposed to overseas markets, which will include currency risk. Equities are less exposed to inflation risk because companies can adjust their prices higher, although ultimately, they do suffer interest rate risk where higher rates can affect demand for their product and their ability to re-pay loans and dividend income.

Absolute Return Funds

- The one thing to point out here is that the ‘absolute return’ is an aspiration not a guarantee! These funds could be open to all the risks mentioned above, but the idea is that they run various strategies to reduce exposure to risk whilst still producing a positive return, although usually with the caveat of ‘annualised over a rolling 3-year period’.

And one overlooked risk

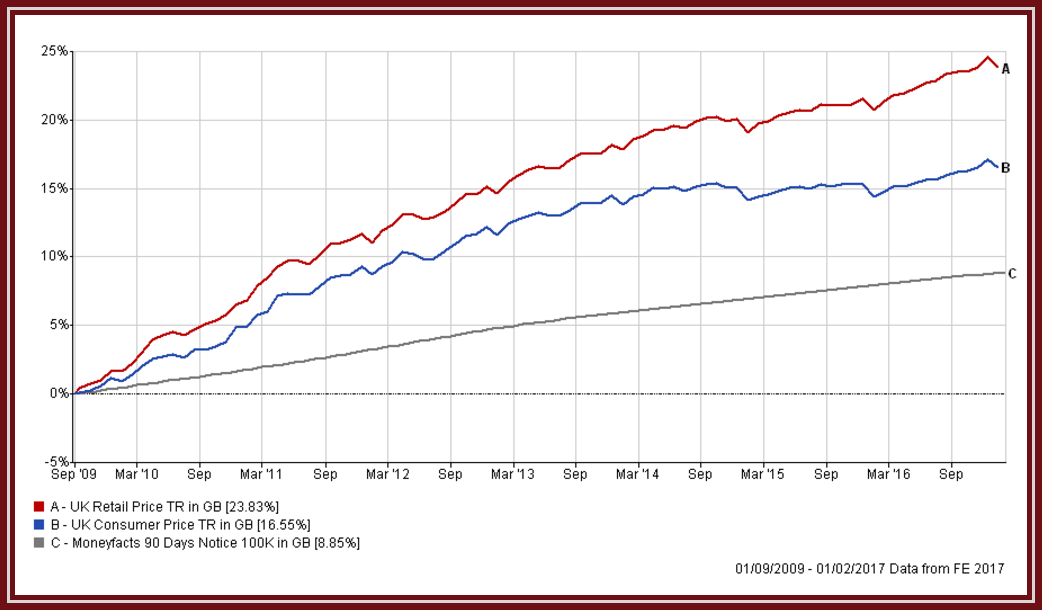

Too often the focus is on the risk of investing, rather than the risk of not investing. Cash is the least risky asset over the short-term, but holding investable cash over the long term runs the risk of being eroded by inflation. Take a look at the chart below:

Even during a period of fairly benign inflation, a cash ‘non-investment’ would be worth less in today’s terms. Over the longer-term equities tend to rise, so an actively monitored ‘buy and hold’ strategy should out-perform inflation.

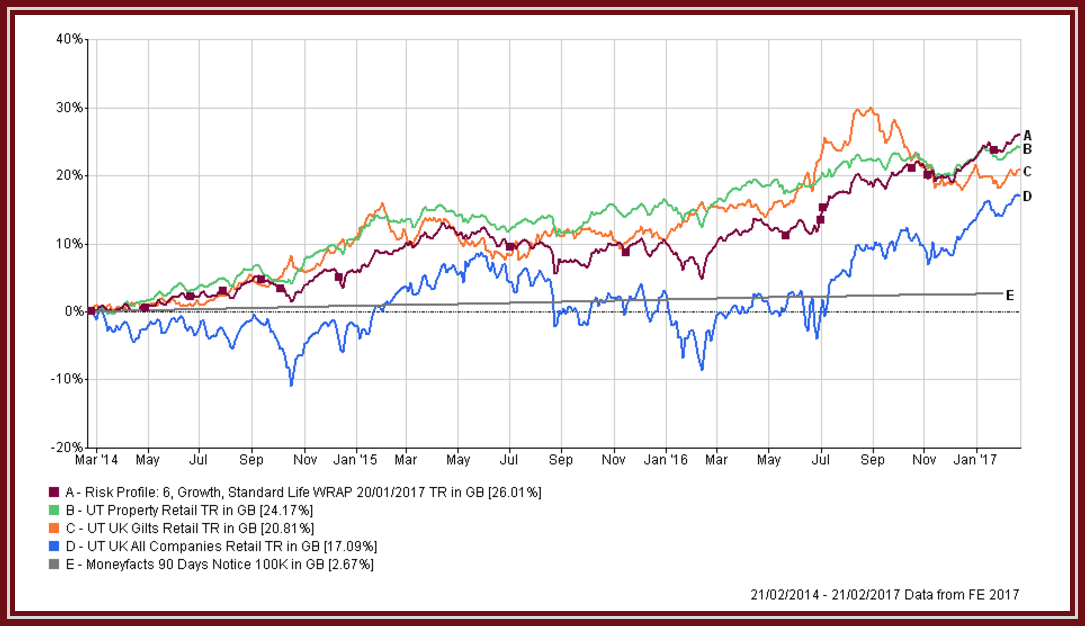

How do we position our funds?

We construct robust, diversified portfolios designed to capture much of the rise in prices but preserve capital when markets fall. Currently we hold less fixed interest than would be expected, preferring a blend of equities, property and absolute return funds. Most funds have a small gold weighting which has proved to work well when other asset prices fell.

The above chart plots our mid-range portfolio against a selection of UK assets; this shows that the portfolio added value but held up better when markets dipped.