A greater interest in the future

INVESTMENT SPECIALIST DAVID WARREN AT DISCRETIONARY INVESTMENT MANAGERS CHARLWOOD IFA SHARES HIS VIEWS ON MARKET EVENTS FOR MARCH 2016

In February I wrote about the merits of remaining invested over the longer term; today I’m going to show the importance of ‘investment plus’, the added benefit of re-invested income, to your overall wealth.

Investing in income-generating funds isn’t just for those with a need for regular pay-outs; the compound effect of re-investing these income flows can, over the long-term, make up the majority of gains.

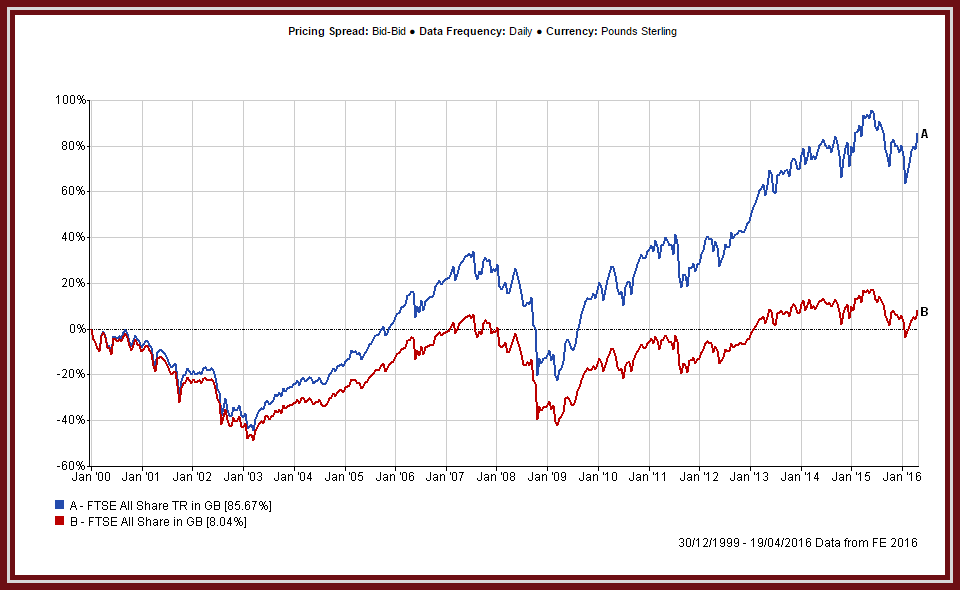

Take a look at this chart of the FTSE All-Share Index; since the start of the millennium this has made a paltry 8% in capital terms. However, once you add back in the re-invested income the return is an impressive 85%. Think of the dividends as a regular investment plan, buying additional units as markets rise and fall, giving a steady increase in units over time.

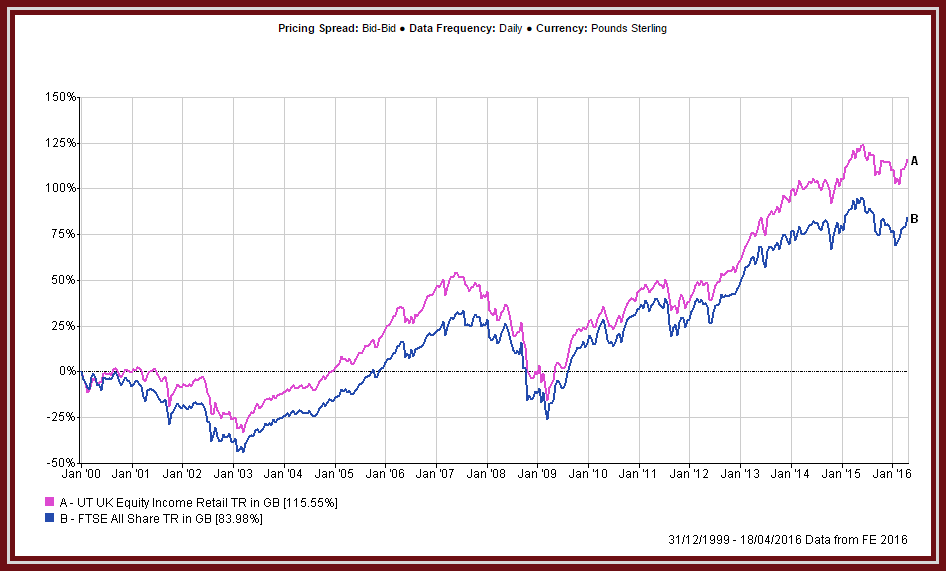

Taking this a stage further the chart below plots the overall return of the UK Equity Income sector verses the FTSE All-Share (to avoid any accusations of selection-bias I also checked the UK All-Companies sector but that was 3% worse than the FTSE index):

In simple terms all funds within the UK Equity Income Sector must yield 10% more than the FTSE All-Share (there’s plenty of small print but that’s the gist), which means that there’s a higher amount re-invested each year.

Income-generating funds form a core part of our portfolios because they are an excellent way of expressing our current lower-volatility approach in two key areas:

- They produce a 3-4.5% income return a year at a time when we don’t expect major gains from most developed stock-markets,

- The commonly held shares in these funds are in sectors that we feel are better positioned to withstand a tough economic climate, healthcare, consumer products and insurance companies for example.

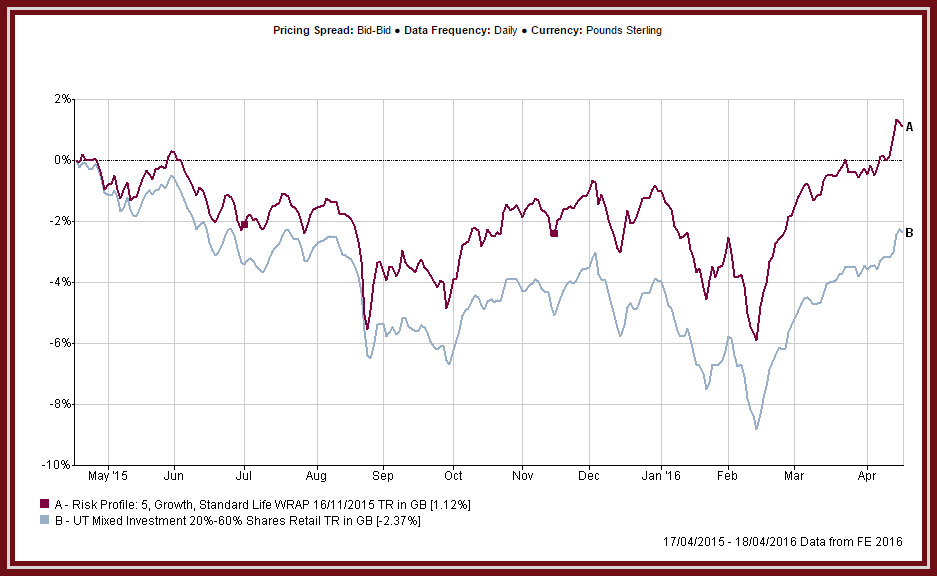

This approach has served us well over the past year and partly explains how we have still produced a small positive return when there have been falls of around 5% in the major UK stock markets and 2.37% in our benchmark index (data up to April 17th).

And the icing on the cake is that when the time comes to switch to an income withdrawal facility your portfolio will have accumulated more fund units, thus producing a larger income stream.