A Post-summer Update

As we return from our virtual summer holidays, we thought it would be useful to update you on the state of the market and, more importantly, on how the portfolios are faring.

Financial markets have taken a rollercoaster ride in 2020, rising and falling with the latest health and economic effects of the Covid-19 pandemic, presidential posturing ahead of the November US election and now the prospect of the UK government breaking international law as Brexit negotiations approach the climax. We have witnessed a stark contrast between the US stock-market, buoyed by a small group of tech stocks (referred to as the FANGS), hitting new highs, and the broad UK index remaining 20% lower than where it began the year. Bond yields fell to record lows, many now offering negative yields, the oil price plummeted 60% and gold rose to a fresh high, above $2000. Never have the benefits of a diversified portfolio been more apparent!

In the midst of this unsettled world, we’d like to reassure you that, despite an initial sell-off, our range of portfolios have recovered to between flat for the lower risk portfolios to down 2% on the highest risk portfolios. Our popular Income portfolio is currently down around 1.3% for the year to date.

All WRAP portfolios are ahead of their respective benchmarks and we have achieved this using a combination of active fund management and our over-riding principle of running diversified portfolios.

Active Management

We had been holding high levels of cash going into 2020, based purely on our view that markets were fully valued and vulnerable to a set-back for any number of reasons. We raised cash levels further at the start of the year and went into February’s market collapse with a high cash balance. This didn’t prevent a fall in the value of our portfolios, with UK equity exposure hit particularly hard. But we took advantage of the sell-off to implement purchases of US and UK index funds at attractive levels. In May and June we sold some funds that had benefitted from the exuberant rally in US shares, increasing our cash levels again.

Diversification

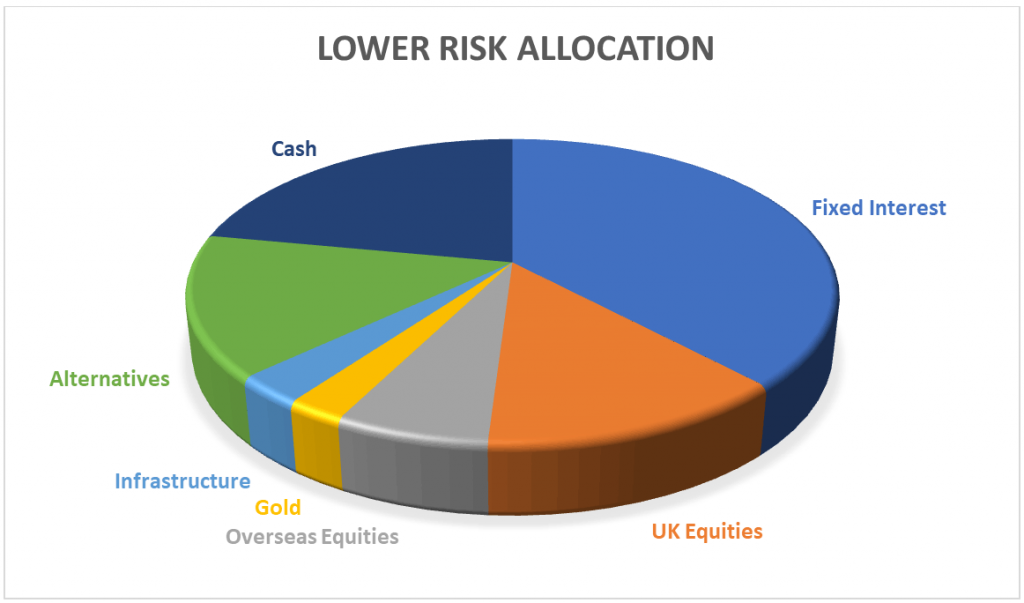

We look to build robust portfolios by using a selection of funds with exposure to different assets such as UK and international shares, bonds, gold, infrastructure, absolute return and property (although not at the moment) to diversify risk; the theory being that different asset groups don’t all rise and fall at the same time. The level of diversification, and the assets used, vary depending on the level of risk required. For example, the lower risk portfolios have a high percentage in fixed-interest as they generally offer greater capital preservation; these portfolios will also have a smaller allocation to overseas equities that carry the additional risk of currency exchange rates.

As the risk category of the portfolios rises, the exposure to fixed interest will fall, usually to zero on the higher risk models, and the weighting in a variety of overseas markets will increase significantly.

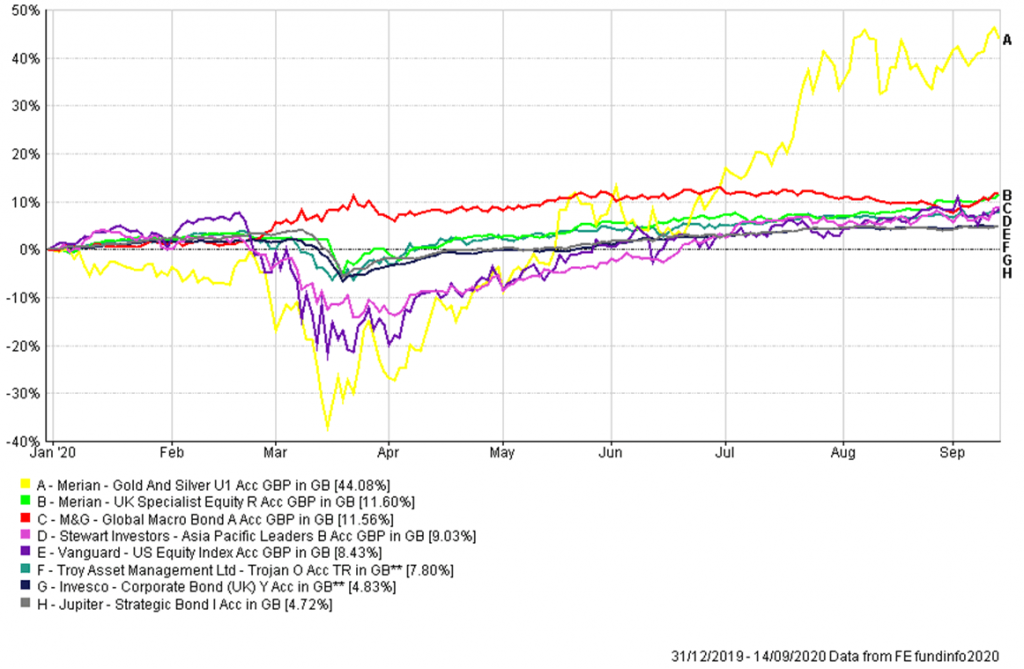

While of course our UK equity funds remain lower year to date, many of our other investments have seen strong gains:

The above chart demonstrates clearly the diverse nature of these gains, from the volatile gold fund, that initially fell by 30% before pushing gains of over 40% on the year, to a more subdued version from US and Asian equity funds, to the stable gains provided by our bond and alternative funds.

Building diversified portfolios that can capture capital growth over the long term while also proving robust at times of market stress is at the heart of our investment strategy at Charlwood IFA.