An update on property funds

INVESTMENT SPECIALIST DAVID WARREN AT DISCRETIONARY INVESTMENT MANAGERS CHARLWOOD IFA SHARES HIS VIEWS ON MARKET EVENTS FOR MAY 2016

Of the main asset groups property is generally the one that attracts the least attention; it’s the quiet plodder that pays out a regular income without getting too excited by day to day events. But all that changed over the past week when a change in the pricing of property funds led to some unfavourable headlines, so I thought it might be useful to provide a simple summary of what’s been happening and how we view this going forward.

THE ATTRACTIONS OF PROPERTY FUNDS

Commercial property funds buy offices, factories, shops and warehouses around the country, offering a commercial and geographical spread of risk. These properties are leased to tenants like the government, BT, Sainsbury, and Royal Bank of Scotland; the leases vary but are typically longer than buy-to-lets, ranging more between 10-15 years. A good percentage of leases use upward-only rent reviews, or reviews linked to inflation. These features mean that generally the fund price moves steadily higher over time with a gentle increase in income.

WHAT’S HAPPENED RECENTLY?

Over the past week four of the large property funds, including two that we invest in, dropped their pricing from an offer basis to mid or bid basis. I won’t bore you with the detail but what this means is that although the value of the fund remains the same, the price at which we would now sell it, and the price at which it’s valued on a daily basis, has fallen by between 5-6%. This swing happens quite a lot across other asset classes but has less impact due to lower dealing costs, and therefore the spread between buying and selling.

So why have the funds done this? Well essentially it’s another paradox of the Financial Conduct Authority’s ruling on treating customers fairly (TCF). Since the start of the year there have been regular inflows into these funds from private investors, but these haven’t matched the size of outflows from institutional multi-asset funds.

Property funds have been running high cash levels so that they can cope easily with money leaving the fund, but their concern is that if these outflows persist then they might need to sell some of their properties. As any home-owner knows, the costs of trading in property are far higher than for standard investments and the FCA reasoning is that these costs shouldn’t fall on long-term investors of the fund; they should be reflected in the price that the units are sold at. This is all pretty reasonable but the paradox is that in doing this the funds have wiped 5-6% off remaining investors’ valuations!

WHAT’S OUR VIEW ON THIS?

Whilst obviously irritating this is an adjustment that will be reversed at some point and we should assess the sector in that light.

Talking to the property fund managers the reasons for this selling by multi-asset funds appear to be three-fold:

1) Concerns that a vote to leave the EU would lead to overseas selling of property and possibly a deterioration in the economy, which would reduce demand for property and put rental-payments at risk.

2) A strangely late reaction to forecasts of lower property returns in 2016; these haven’t changed from the 5-6% bandied around in the second half of last year.

3) Trying to sell their holdings before the price drop that has now happened.

We have no way of knowing when these outflows will dry up, but the drop to mid/bid basis will certainly deter some selling, as will the growing likelihood of a vote to remain in the EU. There’s also the possibility that post the EU referendum a vote to remain re-kindles demand for property, which might see a positive reversal of the 5-6% price swing.

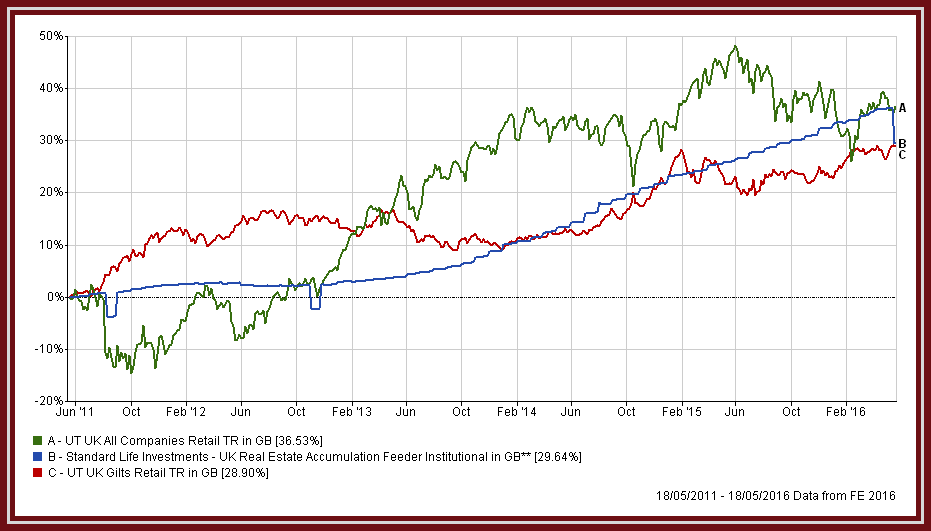

Property funds currently yield in the region of 3-4%, similar to corporate bond funds but with less direct exposure to a rise in bond yields. Equity income funds offer similar yields but also show far more price volatility.

Property isn’t an exciting asset-it’s not meant to be. But it serves a useful purpose in diversifying risk from equities and fixed interest alongside gold and absolute return funds at a time when no asset class looks compelling. Putting aside the events of the past week property is useful in lowering the price movements of our portfolios.