Let’s talk performance

Our typical client is one which is either in retirement or close to retirement. They have accumulated a level of wealth and understandably wish to protect and preserve that wealth. Income often becomes a priority, but with the average life-expectancy increasing so does the need for some capital appreciation.

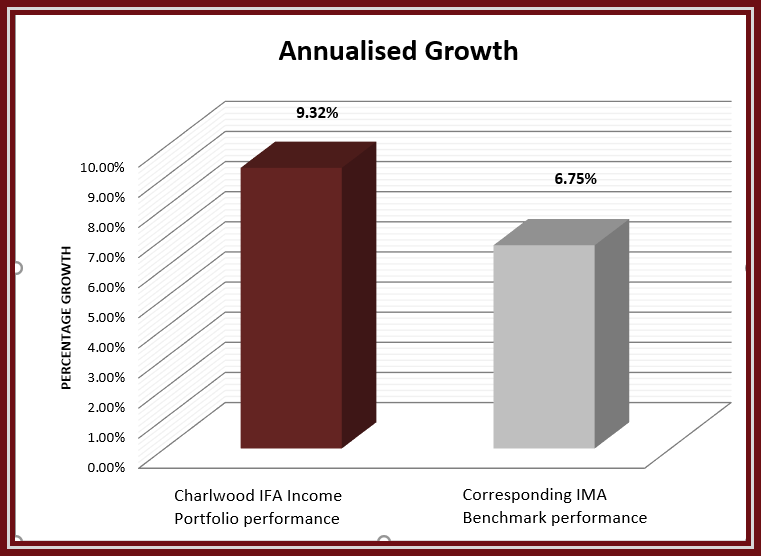

Charlwood IFA run lower risk income portfolios designed to produce a steady income whilst focussing on capital preservation. The chart below shows the average annual gain in our lower risk income fund compared to the Investment Association benchmark (UT Mixed Investment 20%-60% Shares Retail).

Investment Philosophy

Our aim as investment managers is to create portfolios that are structured to maximise returns on a risk-adjusted basis. We do this by combining funds whose price movements aren’t all correlated and that have different patterns of returns. We don’t select funds that will all rise at the same time, preferring a portfolio that benefits from many different outcomes; consistent returns and preservation of capital rank far higher than targeting maximum gains by betting on binary outcomes.

When building a portfolio, we start by deciding which areas to include that offer positive returns and value, as well as diversifying risk; this has been far more difficult since central bank asset-purchase programmes have driven traditional safe-havens like fixed interest bonds to historically expensive levels.

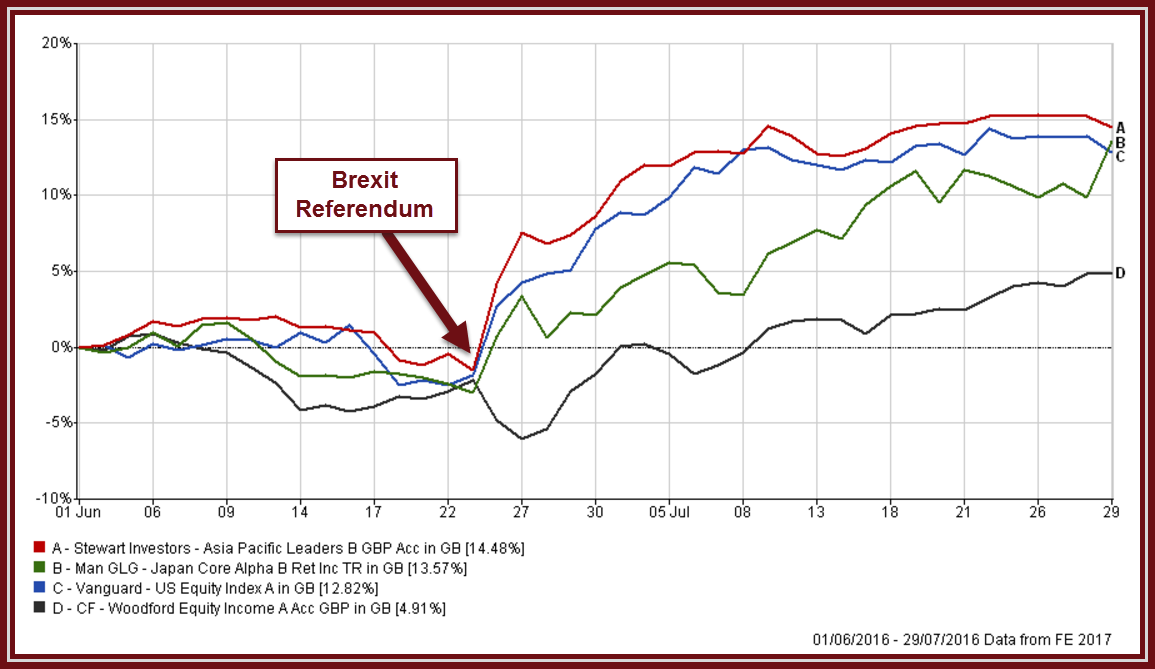

Typically, our income portfolios include a blend of fixed interest with commercial property, UK and overseas equities and absolute return funds. Overseas holdings give exposure to economies that may perform differently to the UK, but also give protection at times when our currency falls. Take a look at the chart below; this shows the aftermath of the Brexit Referendum when sterling collapsed.

I’ve shown the Woodford Equity Income fund as an example of our UK income funds, which were hit immediately on the result. However, our overseas funds made stellar gains of more than 10%, in sterling terms, over the following weeks.

Fund Selection Process

Once we’ve decided on the asset allocation our rigorous fund analysis focuses on funds that have a solid, repeatable investment strategy that is consistent and can out-perform over the investment cycle. These are funds that we feel we understand well, are managed consistent to their investment philosophy and that we are comfortable holding over the longer term. Whilst we obviously consider past performance we look at this in the context of general market moves. For example, when looking for a low risk fixed interest fund the best performances have often been due to a high exposure to interest rates, whereas we’re more interested in funds with a low exposure to interest rates that have little room to fall but plenty of scope to rise.

With apologies for a brief splurge of jargon, the risk metrics that we find more relevant than historic performance are the volatility of the fund’s price, its maximum drawdown (the difference between buying at the highest price and selling at the lowest), the alpha (the value created by the fund management team, rather than the general market move) and the Sharpe ratio (the return produced for the level of risk involved).

We discuss the fund’s objectives with a member of the investment team and back-test funds through differing market conditions to see if the manager’s philosophy stayed true during falling as well as rising markets. Our preference is for funds that hold their value more when markets are falling whilst benefitting from a fair share of the gains during rising markets.

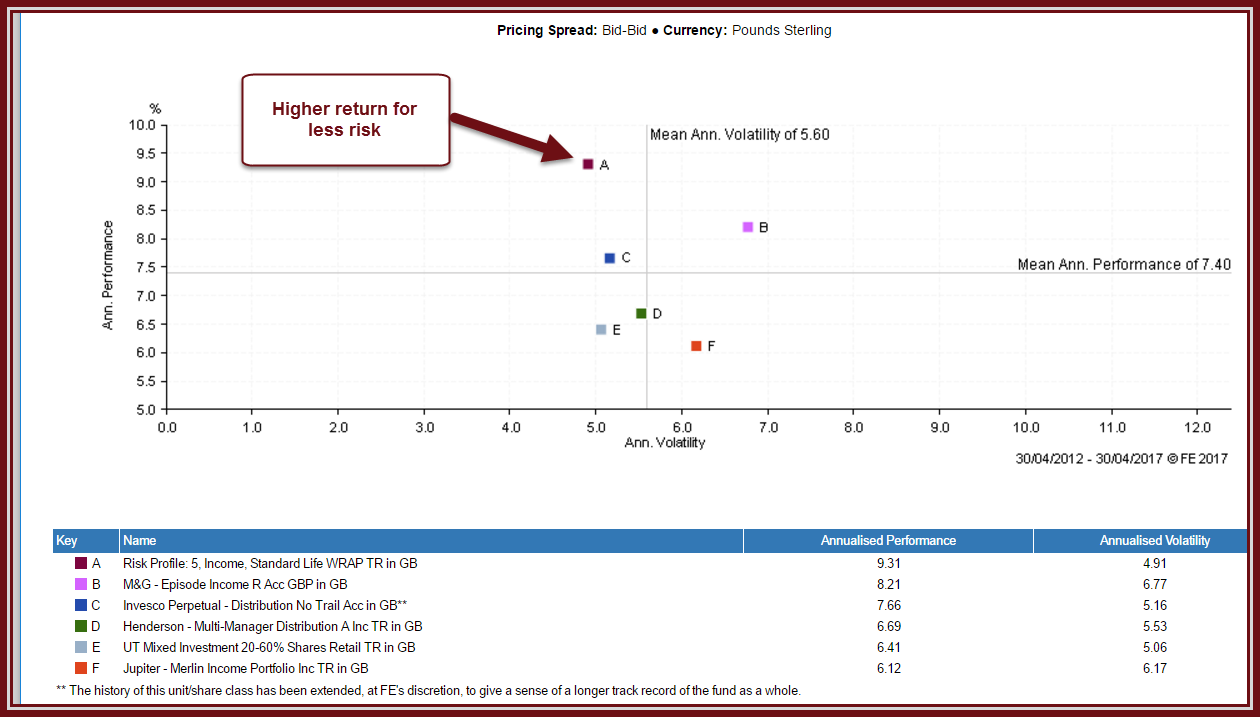

This approach is demonstrated well in the chart below which shows the performance of our lower risk income fund, compared to its benchmark. Although the period generally witnessed rising asset prices, the period between April 2015 and April 2016 trended lower; however, over that period the income fund held steady.

Our style means that fund turnover is low, although we are always on the look-out for alternative options, and that our funds produce a better overall return for less risk. The chart below might look a bit strange but it’s one of our favourites and illustrates our philosophy to maximise returns on a risk-adjusted basis. The chart compares the annualised performance for the past five years with the annualised volatility of the portfolio’s value. For good measure, I’ve included our top competitors in the peer group:

Performance

The total return over 5 years of our lower risk income fund at 53% sits in the top quartile of the Investment Association Mixed Investment 20-60% Shares Retail sector, ranking 13th percentile.

Conclusion

We aim to invest our clients’ wealth in a diversified spread of investments; this rigorous diversification means that all investments are unlikely to move in the same direction at the same time; the advantage to this approach is that we’re able to build robust portfolios that both limit the downside when markets do fall but capture growth over the medium to long term, allowing our clients to sleep well at night.