The Benefits Of Long Term Investing

We all like to think we can time our entry and exit points in the market, but the last 10 years or so clearly demonstrate you never know what is around the corner!

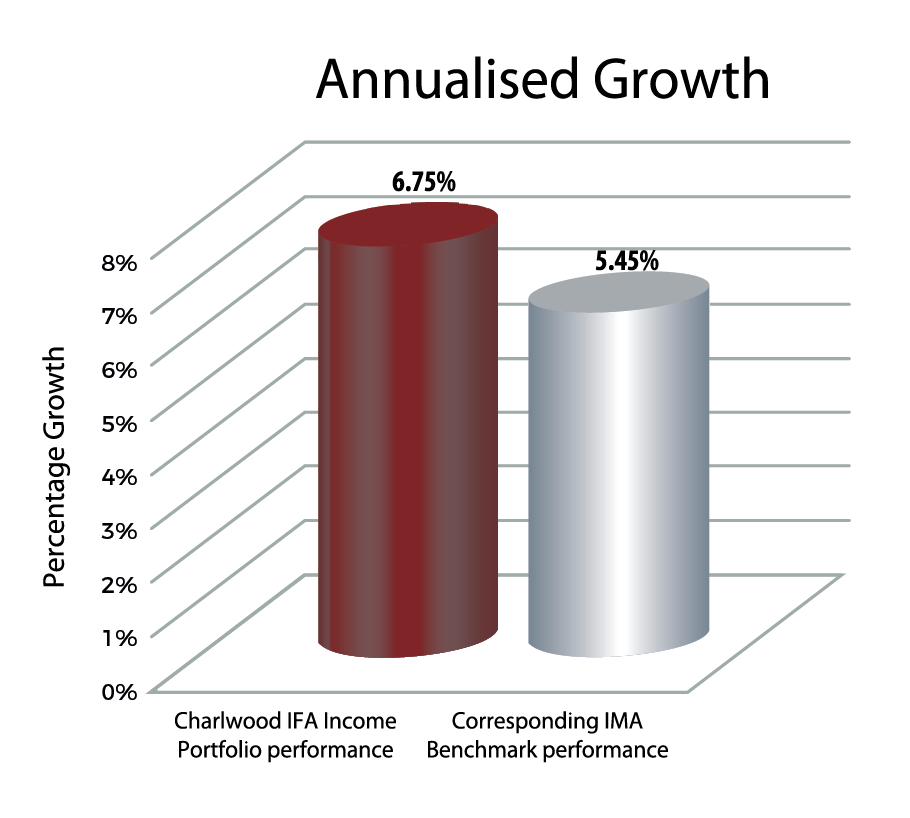

Since 2012, we have witnessed the Taper Tantrum of 2013, the shock of the 2016 Brexit Referendum and its political ramifications, an over-enthusiastic rate-hiking policy by the US Federal Reserve in 2018, and, of course, the pandemic catastrophe of 2020/21. During these challenging times our hugely popular low-medium risk income portfolio has gained 80%, producing annualised equivalent returns of 6.75% pa and as illustrated in the chart below has outperformed its benchmark by a whopping 24% and in doing so has achieved first quartile performance!

Past performance is not a guide to future performance. The value of investments and any income from them can fall as well as rise and is not guaranteed. Based on period 16/07/12-15/06/2021 on a Bid-to-Bid basis with income reinvested and net of investment fund managers charges.

So What Does This Tell Us?

In summary we don’t have a crystal ball and can’t tell you the perfect time to invest but we can endorse the benefits of long term investment. As the eminent economist William Sharpe once stated, based on historical analysis, market-timing traders had to be right an incredible 82% of the time to match the returns of buy-and-hold investors. Last year markets looked pretty scary at times, partly due to the media whipping up a frenzy of apocalyptic headlines rather than use reasoned reporting. Investors that kept their nerve and retained their faith were rewarded with the subsequent market bounce that followed.

Whilst we can’t be certain of what’s around the corner, with U.K. interest rates offering 1% pa at best, (2 year fixed deposit) we can be certain of the value in long term investment!