Small is beautiful when it comes to fund management

We are repeatedly asked, “How do you manage to provide superior returns to many multi-national institutions offering equivalent portfolios to your own?”.

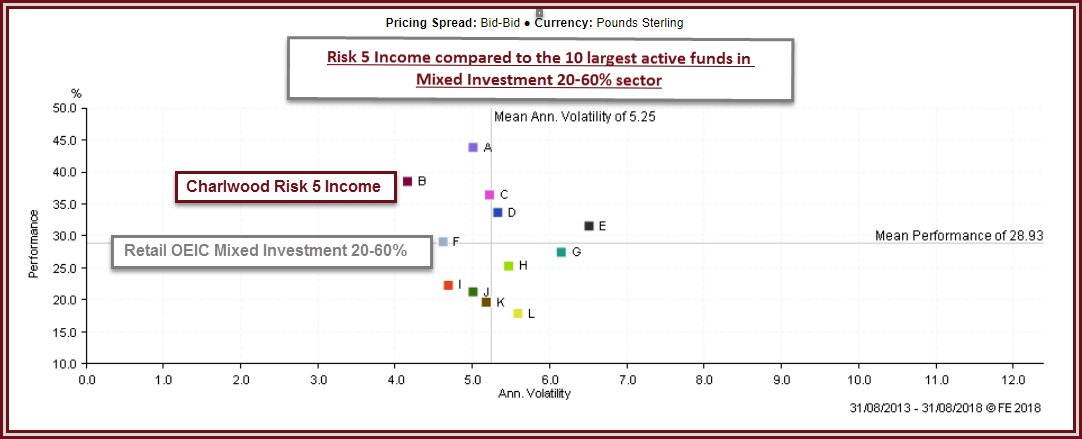

Several industry studies have shown that smaller funds do tend to out-perform larger competitors. That appears counter-intuitive given the resources available to the larger organisations, but smaller outfits can be nimbler, and possibly have the ability to remain more focussed and less bureaucratic. More on that below, but I would like to start by showing a chart comparing our Risk 5 Income portfolio to the Mixed Investment 20-60% benchmark, and to the ten largest actively managed funds in that sector.

Source, FE Analytics

Markets love nothing better than to punish hubris; the idea here was to make a general point about size, rather than draw direct comparisons, so I’ve only named our portfolio and the benchmark. The chart shows that over the past five years our income fund produced the second-highest total return and for the least amount of risk. Below, I’ve listed a few areas where I think that being smaller has helped our performance, and I’ve followed that with a few general points that I believe makes us a good proposition.

Managing our portfolios

All markets covered within a six-foot distance

Being a small team, discussing markets is part of our day to day routine. We average 29 years investment experience per manager, each specialising in different asset groups but having opinions on all areas of investment. There’s no need to schedule meetings to air our views; we simply highlight and chat through topics of interest at the time. We share ideas and debate issues which will sometimes lead to an immediate decision to trade. These trades can quickly be run through our models to check that the resulting risk remains within target, then processed on the desk.

We can always deal in our size

One disadvantage of larger funds is that they may struggle to deal quickly in meaningful size; this might result in poorer dealing terms, or even an inability to trade. It can also affect their investment style, where some attractive opportunities aren’t available in the size they demand. In some cases this problem is further complicated by running parallel mandates for other companies. Regulatory requirements mean that trades have to be considered across the range of mandates. We have no such problems in trading across our full range of funds.

Flexible approach

Our portfolios are risk-targeted; this gives us full discretion to allocate as we see fit, so long as we keep the risk below, or equal to, the risk tolerance set by our clients. The one other parameter is to keep our equity weightings within the Mixed Investment benchmark settings (0-35% for Cautious, 20-60% for medium, and 40-85% for higher risk portfolios). Those weightings and risk targets are the only constraints, other than that we have the flexibility and discretion to allocate to the areas we find most attractive. Our unconstrained approach means that if we don’t like an asset, then we don’t hold it; the benchmarks are a requirement for reporting purposes, not a model requiring us to place small ‘bets’ either side of neutral.

Lack of distractions

The fund managers here focus on what they’re best at, running investment portfolios. Apart from writing the occasional market commentary we are left to concentrate on economic and investment matters, reviewing our fund choices against others and monitoring the risk and allocations on your portfolios. We don’t spend time out of the office on marketing trips and we leave clients in the expert hands of our financial advisers.

Looking after our clients

Clients, not account numbers

At Charlwoods we refer to clients by name, not account numbers. Many of you visit the office for face to face advice or to chat about future requirements. It’s healthy for investment firms to remember that they are dealing with real people, and of the primary importance in protecting their assets as well as growing them.

We work with clients to meet their needs

At Charlwoods you’re not buying a product, but a personal service. Whilst most clients choose our standard model portfolios, some have requested a more bespoke offering, focussing on absolute return funds, offshore bonds, or a need to hold investments in a currency other than sterling.

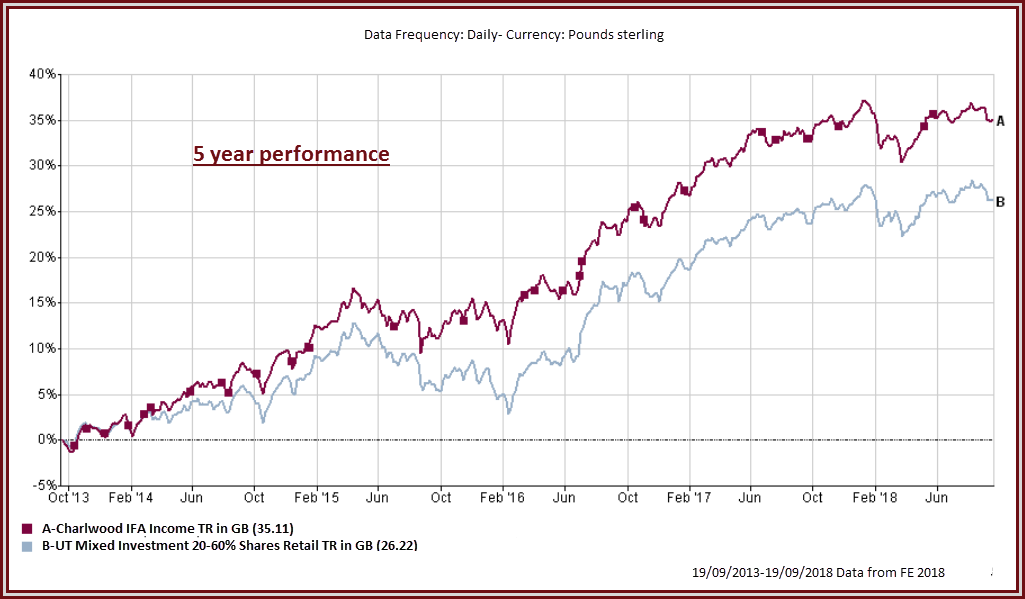

Source, FE Analytics

We tailor income to clients’ requirements

We don’t set a yield target on our income funds because this could lead to unwise investment decisions in order to maintain the yield; protecting and enhancing our clients’ capital is always our primary consideration. Rather, we work with clients to ensure that enough cash is made available to meet their income requirements.

In summary, we believe that our clients benefit from the combination of a large firm Discretionary Fund Management operation but with the personal client-focussed service of a local office.

Please contact us to find out more. Our financial advisers will be more than happy to talk through how Discretionary Investment Management can help you.