Superior performance in both falling and rising markets

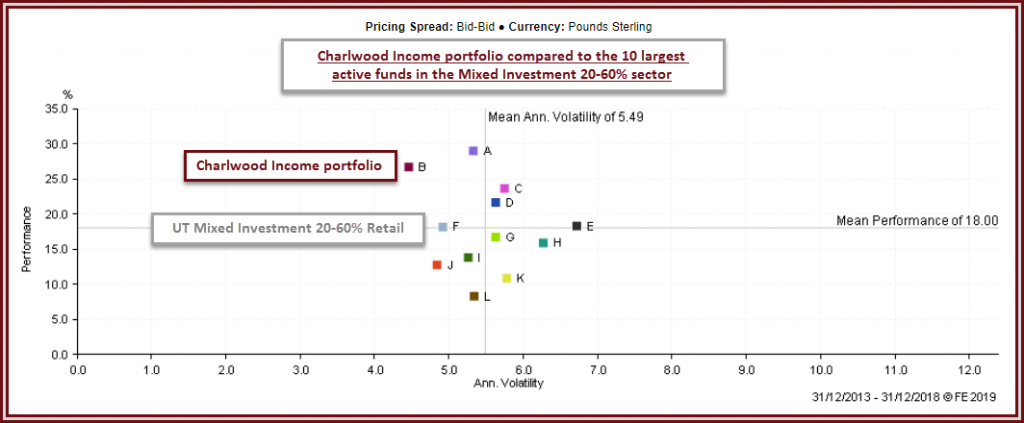

It’s reasonable to say investment markets have had their fair share of up’s and down’s over recent years. As wealth managers we are acutely aware of the importance of minimising and protecting against downside risk in addition to capturing growth in a rising market. We are firmly of the view that the true success of any wealth manager is their ability to perform in both scenarios. On that note we are pleased to share the chart below, which compares our popular income portfolio to its benchmark and to the ten largest actively managed funds in the sector.

The chart shows that over the period 31/12/13-31/12/18 our income portfolio achieved the second highest return but with the lowest level of risk. Our philosophy is further supported by analysis showing that, over the same period, the portfolio captured 102% of the rise in the benchmark but suffered only 78% of the downside.

Our income portfolio has out-performed the benchmark (UT Mixed Investment 20-60% shares Retail) over the 5-year period by 43%; this would place it 16th percentile in the universe of equivalent funds. In fact, all of our standard portfolios have out-performed their respective benchmarks over the 5 years to 31/12/18.