“Time in the market” not “Timing the market”

INVESTMENT SPECIALIST DAVID WARREN AT DISCRETIONARY INVESTMENT MANAGERS CHARLWOOD IFA SHARES HIS VIEWS ON MARKET EVENTS FOR FEBRUARY 2016

Briefly, the idea is that although we all like to think we can time our entry and exit points in the market, just like most economists we perform far better with the aid of hindsight. I’m quite a fan of technical analysis (the dark art of studying charts to predict future market moves) but will freely acknowledge that most patterns are easier to read after the event. The eminent economist William Sharpe stated that market-timing traders had to be right an incredible 82% of the time to match the returns of buy-and-hold investors.

But the adage equally applies to those of a nervous disposition, those that don’t claim to be able to trade the markets but that feel really squeamish after a certain level of losses. So far this year markets have felt pretty uncomfortable and that’s the duty of the media, to whip up a frenzy of apocalyptic headlines rather than use reasoned reporting. As we’ve often said in these columns most of the market worries are known well in advance of any crash but take some catalyst to trigger a reaction.

It wouldn’t have been surprising for some people to throw in the towel recently but how would they be feeling now that the market has bounced?

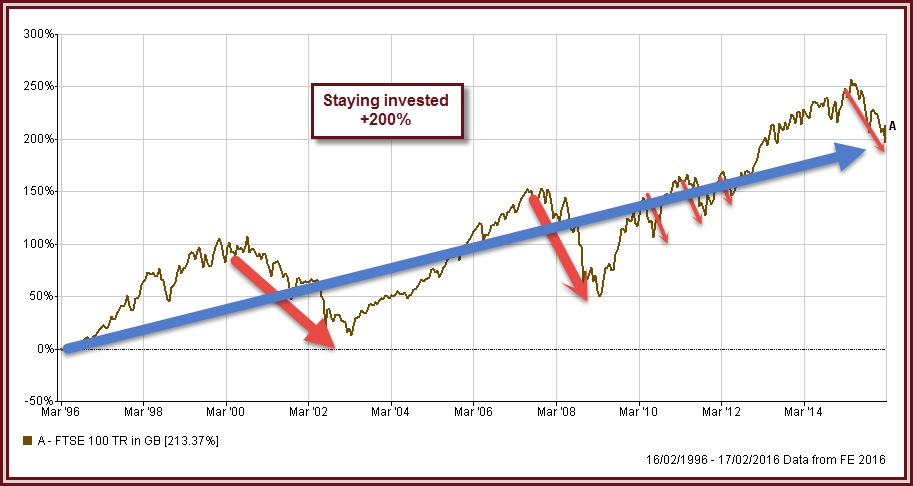

The chart above puts the current market panic into the context of previous crashes, the turn of the century tech bubble, the great crash in 2008-9 and the turbulence surrounding the European debt crisis in 2011-12. Yes, the current downturn has been pretty nasty, and there may be a bit more to come, but the point is that these downturns do occur every few years and yet equities are considerably higher now. The Wall Street Journal reported a study of all bear markets since World War 2, showing that on average stocks rose by 32% in the twelve months after the market bottomed out. But if you had missed the market bottom by just one week this gain fell to 24%. If you had waited 3-months before buying then this gain fell to less than 15%. I should also point out that the chart above shows the total return, that’s to say that dividends are re-invested, again showing the powerful effect of remaining invested in the market.

We can’t be certain of when, or if, markets will fall, however we can be certain of the merit in long-term investing!