Where have the safe havens gone?

INVESTMENT SPECIALIST DAVID WARREN AT DISCRETIONARY INVESTMENT MANAGERS CHARLWOOD IFA SHARES HIS VIEWS ON MARKET EVENTS FOR SEPTEMBER 2016

The ‘positive’ effects of central bank asset-purchases on stock-markets are well documented. Driving up the price of high-quality bonds has caused bond yields to fall, pushing investors into ever riskier assets in the search for income; any set-backs are seen as buying opportunities so bumps in the market are quickly ironed out and markets move ever higher.

However, there are also negative consequences to these actions. In a world where the return on cash is effectively zero the search for income transcends the bond market, reaching into high-quality equities (bond proxies) which in turn make the yields on riskier equities look appealing. This genetic engineering of financial markets threatens to unleash Frankenstein’s monster just as volatility picks up. What we’re talking about here is the positive correlation of asset classes, that’s to say that central bank policies have caused shares and bonds to move in the same direction.

This is what used to happen

Before the Great Financial Crash there was a natural order to markets; strong economic growth would lead to higher company earnings but with rising inflation -so shares would rise in value but bonds would fall, although much higher yields provided some compensation. When growth started to slow down investors would sell shares and move into the safety of bonds.

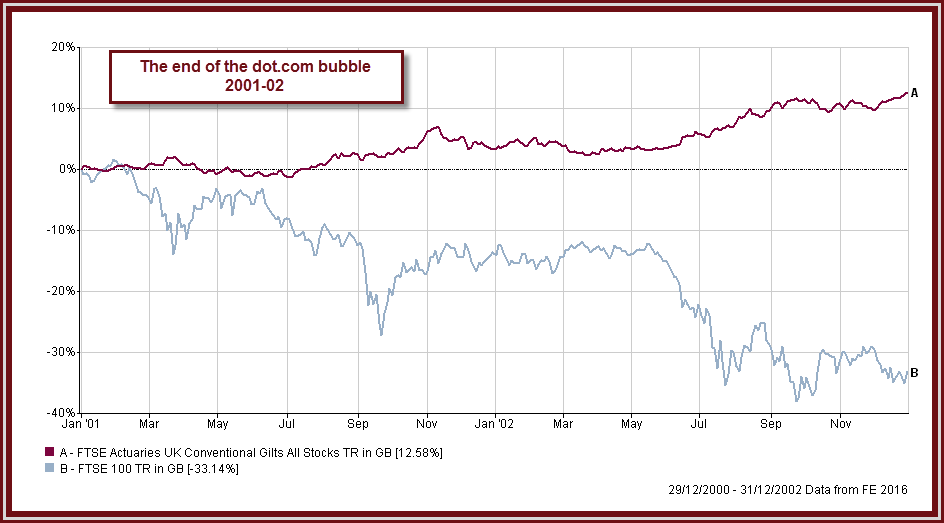

You can see from the chart below that when the dot.com bubble burst in 2001 equities plummeted but bonds provided a counter-balance, rising as investors sought a safer form of income (UK government bonds yielded 5% at this time!).

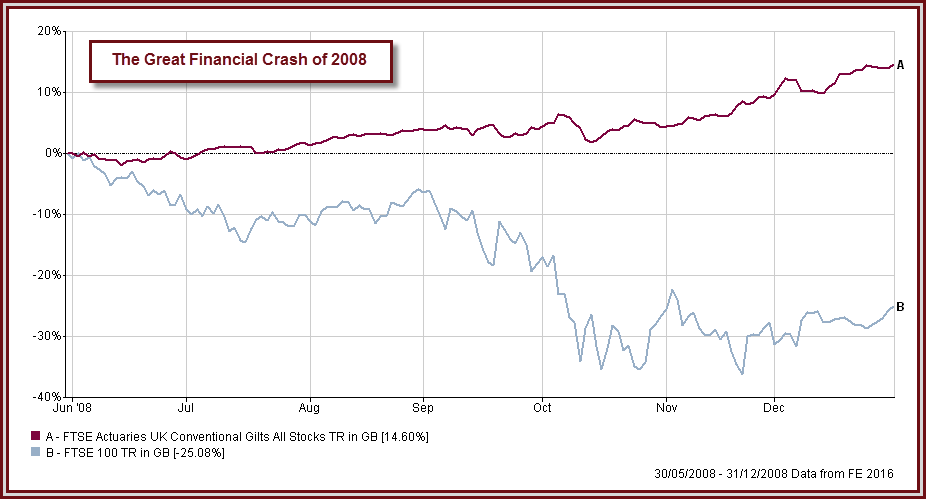

When the irrational exuberances of the ‘noughties’ came to a head in the Great Financial Crash of 2008-9 it was still possible to shelter from the collapse in share prices by holding government bonds, then yielding between 3.5-4%.

Since the introduction of central bank manipulation (starting in the US in 2008) market setbacks have been few and far between- after all, who in their right mind wants to sell the market when there’s a group of very large price-insensitive buyers out there?

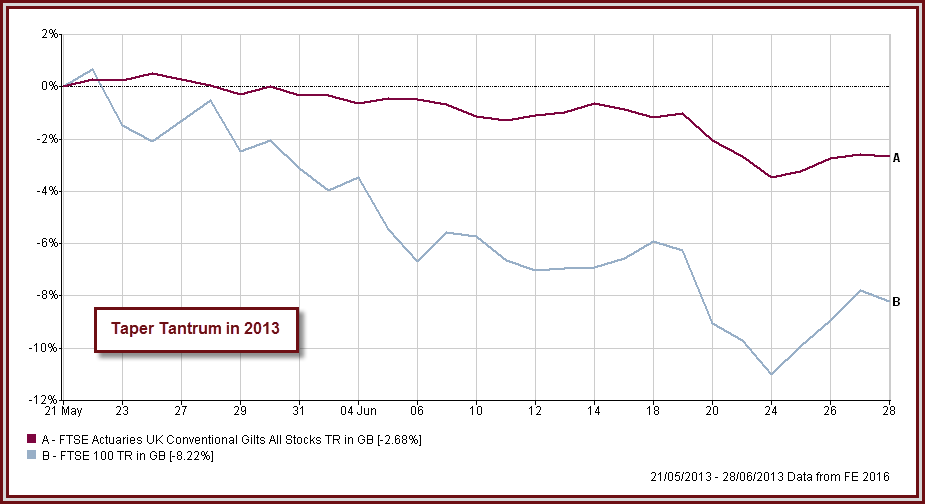

One of the few notable sell-offs was the Taper Tantrum of 2013, when the US Federal Reserve hinted that it might phase out its bond purchasing programme. Here the chart shows that as bond prices fell so did stock-markets but to a greater extent.

The paradox is that the lack of cheap alternatives to switch into is supporting current valuations beyond any level justified by earnings, but it’s also leaving no safe-haven options for when markets turn.

Stock-markets are only a few percentage points off their record highs and government bond yields aren’t far off their record lows, in many cases offering a guaranteed negative return. So there’s a fair chance that at some point both asset classes will see their prices falling at the same time.

Is this likely to continue?

We might get lucky with a change in policies that would cause bond prices to fall, and equities to possibly rise further.

There’s a growing unease that current polices, whilst inflating asset prices, aren’t working on the wider economy. The call for a different course of action, fiscal stimulus, is gaining prominence in the US and UK, though it’s far less likely to find favour in the ruling parts of Europe.

Fiscal stimulus, along the lines of increasing spending on infrastructure projects, is dependent on government action. This would provide a welcome boost to economic growth, which may favour equities, although the increase in government debt would probably cause bonds to fall. At this point the lower yield wouldn’t compensate for the loss of capital.

How do we reduce risk?

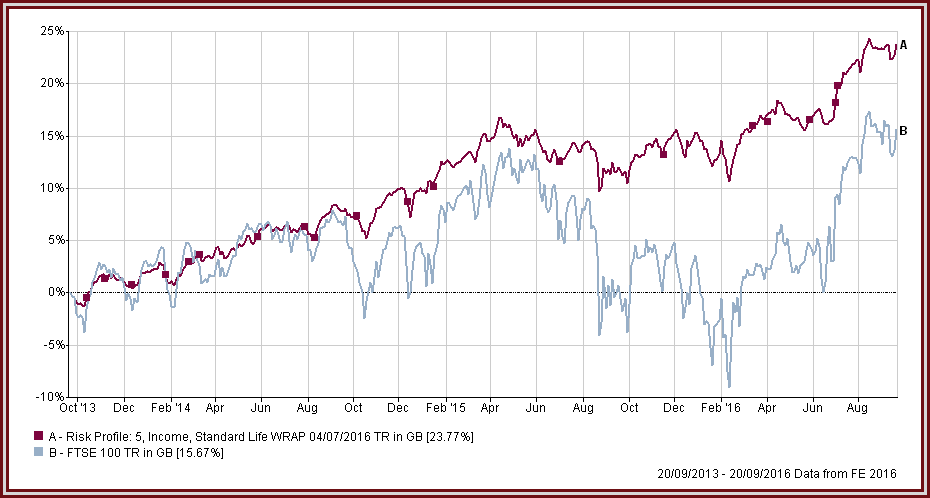

In terms of the way we manage your money we focus on an all-weather approach, running robust portfolios with the aim of capturing a large part of the rise in prices but preserving more of the value when markets fall.

We concentrate on a blend of fixed interest funds that have a lower sensitivity to rising yields with equity funds where income payments are a consistent contributor to overall returns. We look to spread risk by buying funds with exposure to gold, agriculture or commercial property as well as looking at absolute return funds that could benefit in the event of falling prices.

The benefits of this style are shown in the chart above which compares the less volatile performance of our income portfolio to the FTSE 100 over the past three years.