Market Update: October 2014 (Extra Update)

This week the financial markets have made it back onto the front pages with intra-day moves not witnessed for some time. At times like this the media tend to get over-excited and it helps to add some perspective to the headlines.

The list of potential causes for this week’s moves is well-documented in the media but we believe the fundamental reason was that markets were vulnerable to a correction and that several factors contributed towards this, although the eventual catalyst for Wednesday’s mayhem was the volatile US Retail Sales data.

This is something that we have been anticipating and have been writing about in our monthly commentaries for some time now. We didn’t know when it would happen and if we’re honest we can’t say how far markets may fall or over what time scale, however despite the more recent blip we still remain positive of the medium to long term outlook .We think that for our clients there are two key messages.

1) We’re in it for the long term

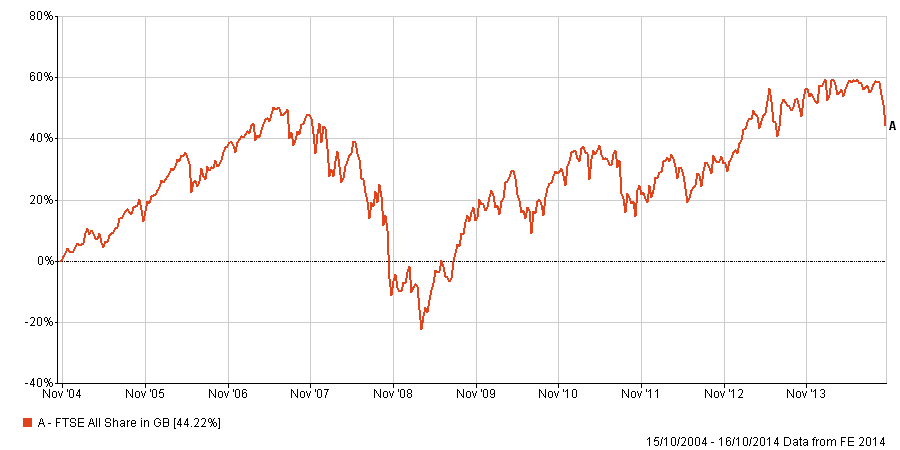

Take a look of the chart for the FTSE All-Share index. We’ve taken it back to 2004 so it obviously includes the financial crash of 2007/08. Even this extreme crash recovered within 6 years.

But the point we’re making is that there were frequent corrections over the years but over the long term investors made significant gains. Market volatility is often talked about as something to fear, a punishment inflicted on investors for taking risk. But we view volatility as presenting opportunities for us to invest at cheaper levels for the longer term.

2) The benefits of a diverse portfolio

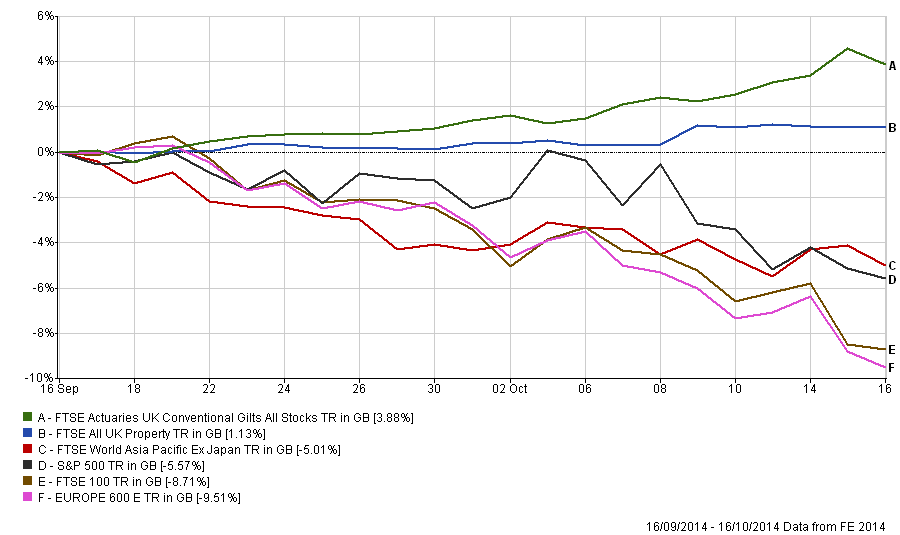

Take a look at the chart below:

Although the FTSE 100 fell by nearly 9% over the past month, and Europe fell by 9.5%, they weren’t representative of all asset classes. Our portfolios contain a blend of Fixed Interest and Property as well as Absolute Return funds and, of course equities. Even within the equity component our over-weight investments in Asia and Emerging Markets have held up well compared to both their comparable indices and other markets.

There are causes for concern, such as the failure of the European Union to implement policies to stimulate growth and whether this will spread globally. Also we have yet to see how markets fare without the helping hand of the US Federal Reserve. But all these headlines fit in neatly with the sell-off; very few of them weren’t already known by investors for some time.

We think that a correction is generally a healthy move to eliminate some of the froth; we still feel that equities represent the best value asset over the next 2-3 years and are using these opportunities to increase the equity weighting in your portfolio.